Sourcing Off Market dealfow

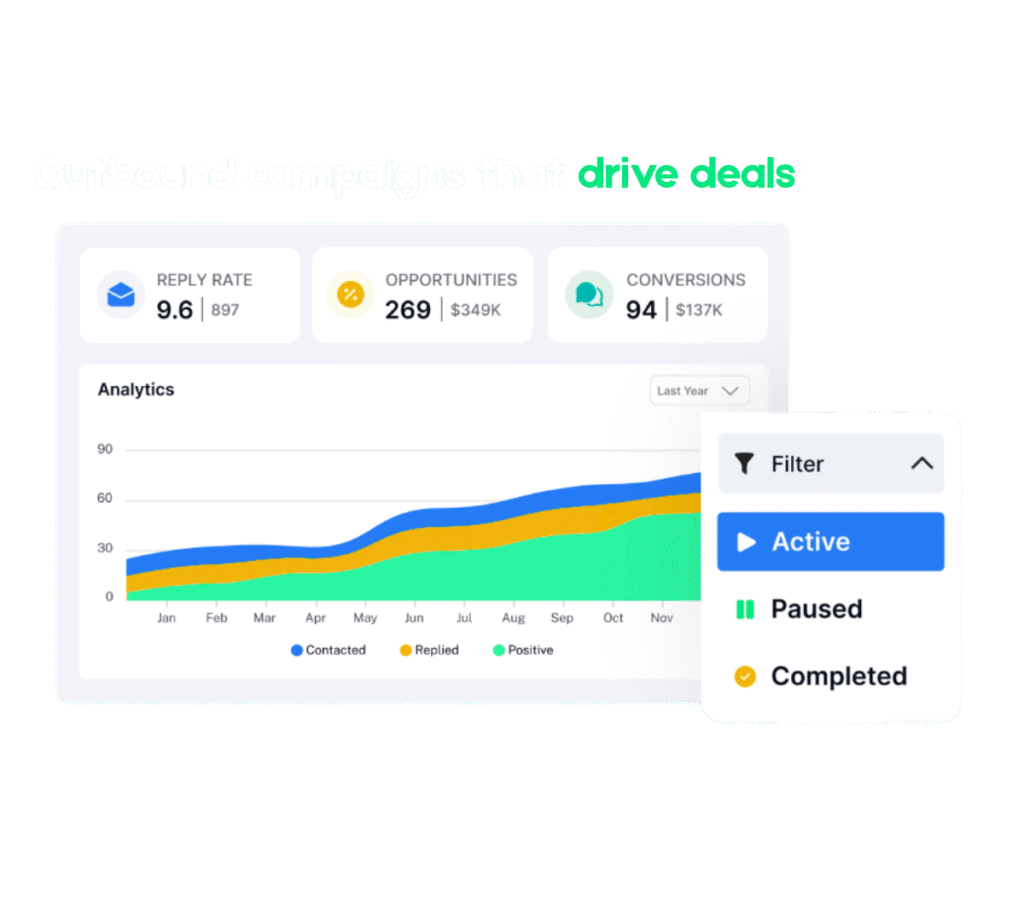

We help acquirers, investment groups, corporate finance firms and business brokers find companies off market interested in selling partial up to total stakes.

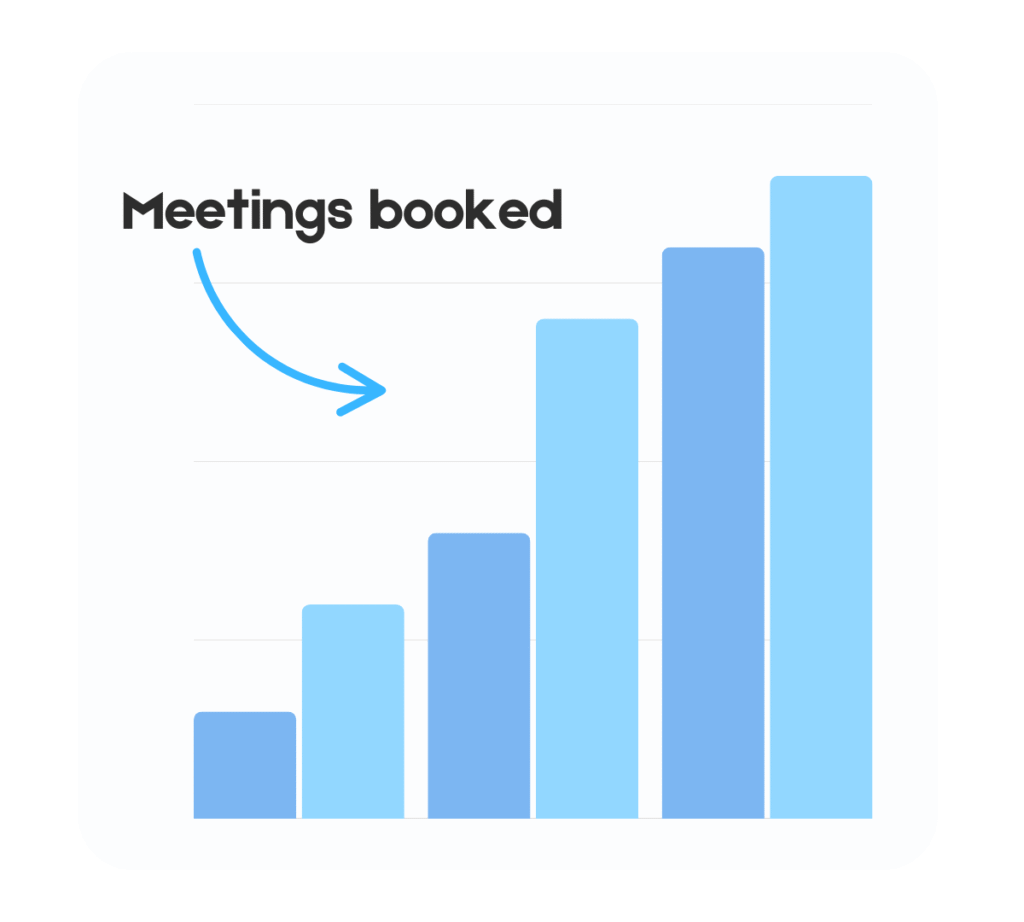

Working with growing holding companies to international conglomerates we drive unique deal flow and booking calls with vendors interested in selling.

How it works

Understanding Your Criteria

We learn more about your investment and acquisition goals, ideal target profile and key financial requirements.

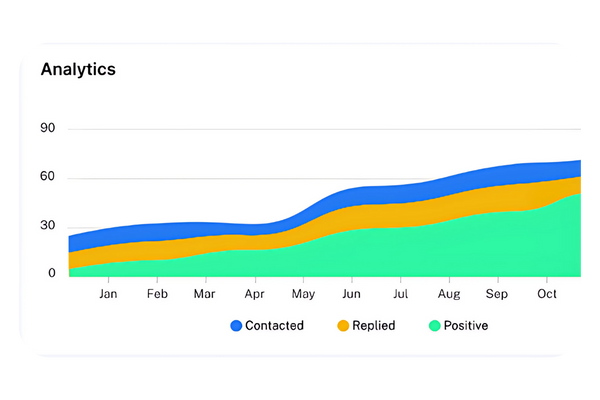

Outreach

We focus on identifying all the potential prospective companies within your criteria. We then reach out to key decision makers: Founders, owners, executives & directors to via phone, LinkedIn & email confidentially.

Qualifying Targets

We manage replies, qualifying companies on a introductory call. If financials and owners aims are aligned with your criteria we schedule a call directly on your calendar.

Case Study:

Consumer Acquisitions

Smarter Capital are acquiring consumer product businesses in manufacturing, wholesale, distribution, e-commerce and retail.

We built a custom pipeline across each of these categories that has driven deal flow with in excess of 300m in revenue.

Karl, Chief Acquisition Officer

“I genuinely couldn’t be happier with what Joe does for us. I can’t say exactly how he does it, but whatever he does it just works.

We have a consistent flow of opportunities to our pipeline, with the majority being a good fit for our requirements”

Karl

We are actively looking for:

Software & SaaS Businesses

Software & SaaS based businesses doing between £2m and £100m revenue, both profitable and unprofitable.

Letting & Property Management

Letting and Property Management firms, doing between £250k-£5m revenue, profitable, anywhere in England

Consumer Product Businesses

Manufacturers, E-commerce Brands, Wholesale & Distributors of consumer products. £2M-£30M in revenue, profitable and unprofitable.

Independent Financial Advisors

Independent Financial Advisors with AUM of £20m+